|

The Brode Report | May 2012

|

||||||||

I love working through complex corporate finance analyses; I'd be happy to

leverage the

style of analysis that I applied here to your problem or project then

Call me at (303) 444-3300 or connect with me on LinkedIn.

|

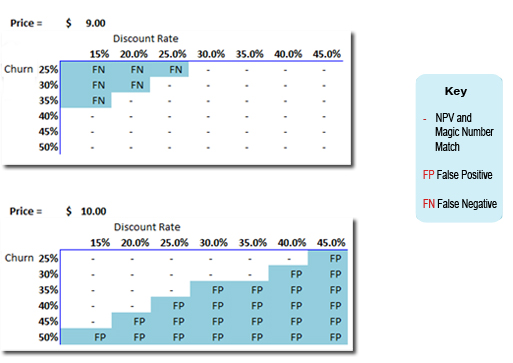

Why does this happen? Well, Magic Number doesnít take timing of cash flows into account because it ignores the discount rate. The other big missing factor is that one of the keys to SaaS economics is the churn rate, which measures how quickly customers leave. A low churn rate means that customers keep paying you for a long time. NPV takes both of these into account.  So in the case of a $9 price, the Magic Number is under 75%, and youíre supposed to move cautiously or work to correct your system. But if your service is sticky and customers stay with you for a relatively long time, then you make up that $1 per month shortfall through longevity. Combined with a low discount rate, and you have a money machine. On the other hand, when the price is $10, Magic Number says to go forward in every case. But if churn is high and your money is expecting venture level returns, the NPV can still be negative. So in the case of a $9 price, the Magic Number is under 75%, and youíre supposed to move cautiously or work to correct your system. But if your service is sticky and customers stay with you for a relatively long time, then you make up that $1 per month shortfall through longevity. Combined with a low discount rate, and you have a money machine. On the other hand, when the price is $10, Magic Number says to go forward in every case. But if churn is high and your money is expecting venture level returns, the NPV can still be negative.

Oh, well. Rules were made to be broken. The spreadsheet used for this analysis can be found here. |

| |

Connect with me | | | Share your thoughts | | | Subscribe | | | See past issues | | | www.brodegroup.com |

| The Brode Group

|

Strategic Financial Consulting - Real-World

Results

|

(303) 444-3300 |

Software as a Service (SaaS) delivery is all the rage, and so Iíve read about rules of thumb for SaaS economics. (As an aside, I feel sorry for

Software as a Service (SaaS) delivery is all the rage, and so Iíve read about rules of thumb for SaaS economics. (As an aside, I feel sorry for