|

Will Amazon be worth $3 Trillion by 2025?

Last week I saw a story on LinkedIn which mentioned that “analysts are debating whether or not Amazon will be valued at” $3 trillon by 2025. The main arguments are: Last week I saw a story on LinkedIn which mentioned that “analysts are debating whether or not Amazon will be valued at” $3 trillon by 2025. The main arguments are:

- Amazon is the largest online store, where their ecosystem is ever growing (Prime, Echo, Dash, etc.), and

- AWS will surpass retail as the dominant revenue stream

When I last checked, Amazon is valued at $312B, so this means they will need to create 10x the value over what the market already expects them to do. This seemed like a bold statement, so I decided to check it out.

If you read my newsletter regularly you know I don’t typically look at public companies because they get so much coverage already. However, I’m happy to step in when spin gets too heavy like with Groupon (here, here, here, and more on the website) or when journalists use misleading charts to make a point.

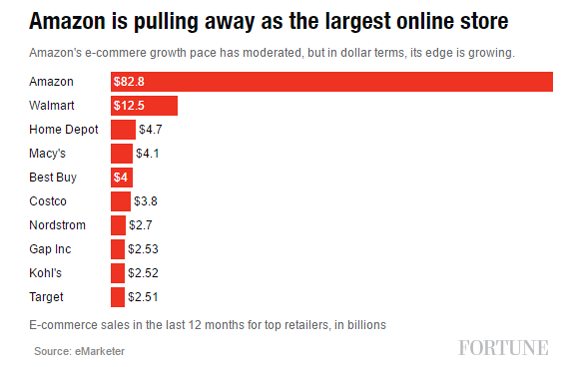

Funny enough, we start with a misleading chart. The LinkedIn article shows this chart:

But when I looked it up on Fortune’s website it looks like this:

Somehow the LinkedIn article exaggerated the Amazon bar until it was about twice as long as it should have been.

In any case, the original argument about Amazon was made by Chamath Palihapitiya, an early Facebook employee and venture capitalist at the Sohn Conference. To his credit, he lays out the $3 trillion argument in a 54-page deck. The argument comes together on page 48, where he discusses how Amazon reaches that lofty perch as summarized below:

| Components of Amazon's Value ($B) |

| |

2015 |

2025 |

| Retail |

200 |

924 |

| AWS |

150 |

1,555 |

| Investments |

- |

163 |

| Net Cash |

8 |

369 |

| |

358 |

3,011 |

Now it’s not clear why he values Retail and AWS as they are in 2015, but that’s not essential to the argument. The key piece that I noticed is that this is more a thesis about AWS than it is about Retail. True, this values Retail at nearly $1 trillon, or almost as much as Apple and Google combined today, so it is making a bold statement about Retail. But let’s leave that aside and focus on the contention that AWS will be worth over $1.5 trillion, as much as three Google’s today. How is that justified? Oddly enough in a 54-page deck, this only takes three pages, p.33-35. The assumptions and calculations follow this logic:

| 2025 Cloud Computing Market Size ($B) |

| |

|

Total |

Cloud % |

Cloud Revs |

| |

Production |

1,700 |

30% |

510 |

| |

Test + Development |

300 |

70% |

210 |

| |

|

2,000 |

|

720 |

Now I’ll note that none of these assumptions were documented and thus are hard to assess. I’ll accept them for the sake of argument. Palihapitiya gets to $1.5 trillion with this methodology:

| 2025 AWS Value |

| |

Market Revenues |

720 |

| |

AWS Share |

|

| |

Total Revenue |

432 |

| |

EBIT Margin |

30% |

| |

EBIT |

130 |

| |

Multiple |

12.0 |

| |

Value |

1,555 |

As you can see, there are three new assumptions here. Again, I’ll accept the 30% EBIT margin for now, but I do have issues with the other two inputs. Palihapitiya does not document why he gave AWS a 60% share. At one time they held a fantastically dominant position in the new cloud services market, but that was back in 2011. My favorite quote from that time was 451 Group in the WSJ saying “In terms of market share, AWS is Coke and there isn’t yet a Pepsi.” But where there’s a buck to be made you’ll find competition--especially on commodity products. The data I see suggests that AWS is currently at 25-30% market share while competitors (Microsoft, IBM, Google) are growing more quickly than AWS, which suggests market share erosion--not doubling to 60%. Perhaps 30% is a more supportable assumption. That would suggest AWS revenue of $216B in 2025. To hone in on this, remember that the original LinkedIn article also discussed when AWS would be bigger than Retail and used a Deutsche Bank chart showing that AWS surpassed Retail Gross Profit in 2024 with revenues of $100B. Even allowing for 20% growth to 2025, that puts revenues at $120B, a far cry from Palihapitiya’s $432B. As you can see, there are three new assumptions here. Again, I’ll accept the 30% EBIT margin for now, but I do have issues with the other two inputs. Palihapitiya does not document why he gave AWS a 60% share. At one time they held a fantastically dominant position in the new cloud services market, but that was back in 2011. My favorite quote from that time was 451 Group in the WSJ saying “In terms of market share, AWS is Coke and there isn’t yet a Pepsi.” But where there’s a buck to be made you’ll find competition--especially on commodity products. The data I see suggests that AWS is currently at 25-30% market share while competitors (Microsoft, IBM, Google) are growing more quickly than AWS, which suggests market share erosion--not doubling to 60%. Perhaps 30% is a more supportable assumption. That would suggest AWS revenue of $216B in 2025. To hone in on this, remember that the original LinkedIn article also discussed when AWS would be bigger than Retail and used a Deutsche Bank chart showing that AWS surpassed Retail Gross Profit in 2024 with revenues of $100B. Even allowing for 20% growth to 2025, that puts revenues at $120B, a far cry from Palihapitiya’s $432B.

Then we turn to the multiple. Palihapitiya asserts that 12x is the 2016 multiple for Intel, Oracle, and IBM. When I do the math I get 10.2x.

|

INTC |

ORCL |

IBM |

Avg |

Market Cap |

|

|

|

|

2015 EBIT |

|

|

|

|

Multiple |

9.8 |

11.9 |

8.9 |

10.2 |

Now, we could do a series of newsletters about the assumptions hidden inside a multiple number, but suffice to say these high multiples assume lots of future growth. But by the time cloud computing has taken over all relevant niches, you can  only grow as fast as the economy in the long run. So I’d argue that an even lower multiple would be appropriate: 4-6x. only grow as fast as the economy in the long run. So I’d argue that an even lower multiple would be appropriate: 4-6x.

We can now pull all this together. While Palihapitaya suggests $1,555B as the value applying more defensible assumptions takes away most of this value. Call me a skeptic on Amazon hitting $3 trillion.

| 2025 AWS Value Scenarios |

| |

|

Palihapitaya |

30% Share, Current Multiple |

Deutsche Bank Revenue, Lower Multiple |

| |

Market Revenues |

720 |

720 |

|

| |

AWS Share |

|

|

|

| |

Total Revenue |

432 |

216 |

120 |

| |

EBIT Margin |

|

|

|

| |

EBIT |

130 |

65 |

36 |

| |

Multiple |

|

|

|

| |

Value |

1,555 |

661 |

216 |

| |

% of Palihapitaya |

100% |

43% |

14% |

|

Last week I saw a story on LinkedIn which mentioned that “analysts are debating whether or not Amazon will be valued at” $3 trillon by 2025. The main arguments are:

Last week I saw a story on LinkedIn which mentioned that “analysts are debating whether or not Amazon will be valued at” $3 trillon by 2025. The main arguments are: